Accounting 1 fbla practice test – Embark on a journey to conquer the FBLA Accounting 1 Practice Test! This comprehensive guide will illuminate the path to success, empowering you with a deep understanding of key concepts, practice problems, and test-taking strategies. Prepare to shine in the competition and showcase your accounting prowess.

Delve into the intricacies of accounting principles, master various question types, and gain invaluable insights into effective test-taking. With this guide as your compass, you’ll navigate the FBLA Accounting 1 Practice Test with confidence and emerge victorious.

Overview of Accounting 1 FBLA Practice Test

The Accounting 1 FBLA Practice Test is an essential tool for students preparing for the FBLA competition. The test is designed to provide students with an overview of the topics that will be covered on the actual competition, and to help them identify areas where they need additional practice.

The test is divided into three sections: financial accounting, managerial accounting, and accounting information systems. Each section covers a variety of topics, including the accounting cycle, financial statements, budgeting, and cost accounting.

Importance of Preparing for the FBLA Competition

Preparing for the FBLA competition is important for a number of reasons. First, it can help students improve their understanding of accounting concepts. Second, it can help students develop the skills they need to succeed in the competition. Third, it can help students earn recognition for their achievements.

The FBLA competition is a great way for students to showcase their accounting skills and knowledge. It is also a great way to network with other students and professionals in the field of accounting.

Key Concepts Tested: Accounting 1 Fbla Practice Test

The FBLA Practice Test for Accounting 1 evaluates students’ understanding of fundamental accounting principles and procedures.

These include:

Accounting Equation

- The relationship between assets, liabilities, and equity.

- Interpreting the accounting equation to analyze a company’s financial position.

Journal Entries

- Recording business transactions in the general journal.

- Analyzing and understanding the effects of journal entries on financial statements.

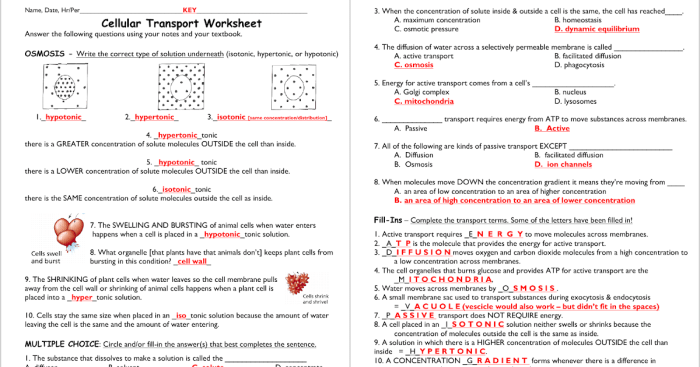

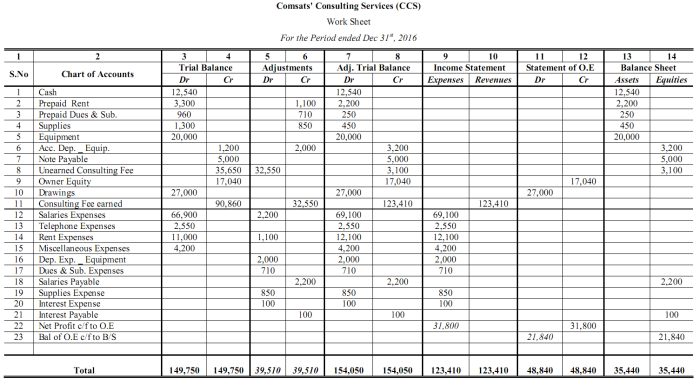

Trial Balance

- Preparing a trial balance to ensure the equality of debits and credits.

- Using the trial balance to identify potential errors in accounting records.

Financial Statements

- Creating and interpreting income statements, balance sheets, and cash flow statements.

- Analyzing financial statements to assess a company’s financial performance and health.

Adjusting Entries

- Recording adjusting entries to update financial statements at the end of an accounting period.

- Understanding the impact of adjusting entries on financial data.

Closing Entries

- Closing revenue, expense, and drawing accounts at the end of an accounting period.

- Preparing a post-closing trial balance to verify the accuracy of closing entries.

Bank Reconciliation

- Reconciling bank statements with company records.

- Identifying and correcting discrepancies between bank statements and accounting records.

Types of Questions

The practice test consists of various types of questions, each designed to assess different aspects of accounting knowledge and skills.

After conquering that Accounting 1 FBLA practice test, I decided to reward myself with some history reading about food and drink in the Elizabethan era . I always find it fascinating how much our eating habits have changed over time.

Then it’s back to the books for more practice questions!

Question Formats

The practice test includes the following question formats:

- Multiple Choice:Questions that provide several answer options, from which only one is correct.

- True/False:Questions that require the test-taker to indicate whether a statement is true or false.

- Short Answer:Questions that require the test-taker to provide a brief, written response.

- Case Study:Questions that present a real-world scenario and require the test-taker to analyze and apply accounting principles.

Difficulty Levels

The questions on the practice test are classified into three difficulty levels:

- Easy:Questions that cover basic accounting concepts and require minimal knowledge.

- Medium:Questions that require a deeper understanding of accounting principles and their application.

- Difficult:Questions that challenge the test-taker’s ability to analyze complex accounting scenarios and apply advanced accounting principles.

The following table summarizes the different types of questions, their formats, and difficulty levels:

| Question Type | Format | Difficulty Level |

|---|---|---|

| Multiple Choice | Single correct answer from multiple options | Easy, Medium, Difficult |

| True/False | Indicate whether a statement is true or false | Easy, Medium |

| Short Answer | Provide a brief, written response | Easy, Medium, Difficult |

| Case Study | Analyze and apply accounting principles to a real-world scenario | Medium, Difficult |

Practice Problems and Solutions

To enhance your preparation, we present a collection of practice problems meticulously crafted to cover the key concepts of Accounting 1. These problems are meticulously categorized into s, allowing you to focus your efforts on specific areas. Each problem is accompanied by a comprehensive solution, providing you with a step-by-step guide to mastering the concepts.

By diligently solving these practice problems and thoroughly understanding the solutions, you will develop a solid foundation in Accounting 1 and increase your confidence in tackling the FBLA Practice Test.

1: Financial Statements

- Define the balance sheet, income statement, and statement of cash flows.

- Explain the purpose and significance of each financial statement.

- Identify the key components and relationships within each financial statement.

2: Accounting Equation and Transactions

- State the fundamental accounting equation and explain its significance.

- Describe the types of business transactions and their impact on the accounting equation.

- Record transactions using journal entries, ensuring proper debit and credit entries.

3: Adjusting Entries and Trial Balance

- Explain the purpose and types of adjusting entries.

- Record adjusting entries to update financial statements at the end of an accounting period.

- Prepare a trial balance to verify the equality of debits and credits.

4: Closing Entries and Financial Statements

- Describe the purpose of closing entries.

- Record closing entries to transfer revenue and expense balances to retained earnings.

- Prepare a post-closing trial balance to verify account balances after closing.

Test-Taking Strategies

Effective test-taking strategies can significantly improve your performance on the Accounting 1 FBLA Practice Test. Time management, question selection, and review techniques are crucial aspects to consider.

Time Management

Allocate your time wisely during the test. Determine the time available for each question and stick to it. Start with questions you are confident about to build momentum and save time for more challenging ones.

Question Selection

Scan the test quickly to identify easy questions and those you can answer quickly. Begin with these questions to build confidence and free up time for more complex ones. Skip questions you are unsure of and return to them later if time permits.

Review Techniques, Accounting 1 fbla practice test

Once you have completed the test, review your answers carefully. Check for any errors in calculations or missed information. Use the time remaining to clarify any doubts and ensure your responses are accurate.

Additional Resources

To enhance your preparation for the FBLA Accounting 1 competition, consider utilizing the following resources:

Relevant Study Materials:

- Accounting Principles, 11th Editionby Jerry J. Weygandt, Paul D. Kimmel, and Donald E. Kieso

- Khan Academy: Introduction to Accounting

- Coursera: Introduction to Financial Accounting

FBLA Competition Rules and Registration:

Essential FAQs

What is the purpose of the FBLA Accounting 1 Practice Test?

The FBLA Accounting 1 Practice Test is designed to prepare students for the FBLA Accounting 1 competition. It helps them assess their understanding of key accounting concepts and identify areas for improvement.

What types of questions are included in the practice test?

The practice test covers a range of question types, including multiple choice, true/false, and short answer questions. It also includes a section on financial statement analysis.

How can I prepare for the FBLA Accounting 1 Practice Test?

To prepare for the practice test, students should review their accounting textbooks, complete practice problems, and take advantage of online resources. They should also familiarize themselves with the FBLA Accounting 1 competition rules and format.